How Insurance Agency In Dallas Tx can Save You Time, Stress, and Money.

Wiki Article

All About Commercial Insurance In Dallas Tx

Table of ContentsThe 6-Minute Rule for Commercial Insurance In Dallas TxA Biased View of Insurance Agency In Dallas TxThe 5-Second Trick For Home Insurance In Dallas TxThe Basic Principles Of Commercial Insurance In Dallas Tx 8 Simple Techniques For Home Insurance In Dallas Tx

The premium is the quantity you pay (commonly regular monthly) in exchange for medical insurance. Cost-sharing describes the portion of eligible medical care costs the insurance provider pays and also the section you pay out-of-pocket. Your out-of-pocket costs might include deductibles, coinsurance, copayments as well as the complete cost of medical care services not covered by the plan.This kind of health insurance coverage has a high insurance deductible that you have to fulfill prior to your wellness insurance policy coverage takes effect. These plans can be best for individuals that want to conserve cash with reduced monthly premiums as well as don't prepare to use their medical protection thoroughly.

The disadvantage to this kind of insurance coverage is that it does not meet the minimal essential coverage required by the Affordable Care Act, so you may also be subject to the tax obligation charge. Additionally, short-term plans can exclude coverage for pre-existing problems (Home insurance in Dallas TX). Temporary insurance coverage is non-renewable, as well as doesn't consist of insurance coverage for preventative treatment such as physicals, injections, dental, or vision.

Consult your own tax obligation, audit, or legal advisor rather of relying upon this article as tax, accounting, or lawful guidance.

The Definitive Guide to Health Insurance In Dallas Tx

You should also note anybody who sometimes drives your vehicle. While the policy just needs you to detail "customary" operators, insurance firms often interpret this term broadly, and some call for that you list any individual that may use your vehicle. Typically, chauffeurs who have their very own vehicle insurance plan can be noted on your policy as "deferred operators" at no service charge.You can commonly "omit" any kind of home participant that does not drive your automobile, yet in order to do so, you need to send an "exclusion type" to your insurer. Motorists who only have a Learner's Authorization are not required to be noted on your policy until they are totally licensed.

The Best Strategy To Use For Health Insurance In Dallas Tx

Plus, as your life changes (claim, you obtain a new work or have an infant) so ought to your protection. Below, we have actually described briefly which insurance protection my review here you ought to strongly consider acquiring at every phase of life. Keep in mind that while the plans listed below are prepared by age, naturally they aren't prepared in rock.Right here's a brief introduction of the policies you require and when you require them: Many Americans require insurance coverage to afford medical care. Picking the plan that's right for you might take some research study, yet it functions as your initial line of defense versus clinical debt, one of largest sources of financial debt among customers in the US.

In 49 of the 50 US states, motorists are required to have automobile insurance to cover any type of possible building damage as well as physical harm that may arise from an accident. Automobile insurance coverage prices are mainly based upon age, credit rating, cars and truck make and version, driving document and place. Some states also take into consideration sex.

Special needs insurance policy is suggested to give revenue ought to you be handicapped as well as not able to work. If you're relying on a stable paycheck to support yourself or your family, you should have disability insurance.

9 Simple Techniques For Truck Insurance In Dallas Tx

An insurance company will consider your house's area, as well as the size, age and develop of the home to identify your insurance costs. Residences in wildfire-, tornado- or hurricane-prone areas will often command higher premiums. If you offer your house and also return to renting, or make other living plans.

For individuals that are maturing or disabled and need aid with everyday living, whether in an assisted living facility or via hospice, long-term care insurance can help take on the excessively high costs. This is the kind of point individuals do not think of till they obtain older and also understand this may be a reality for them, but obviously, as you grow older you obtain more pricey to guarantee.

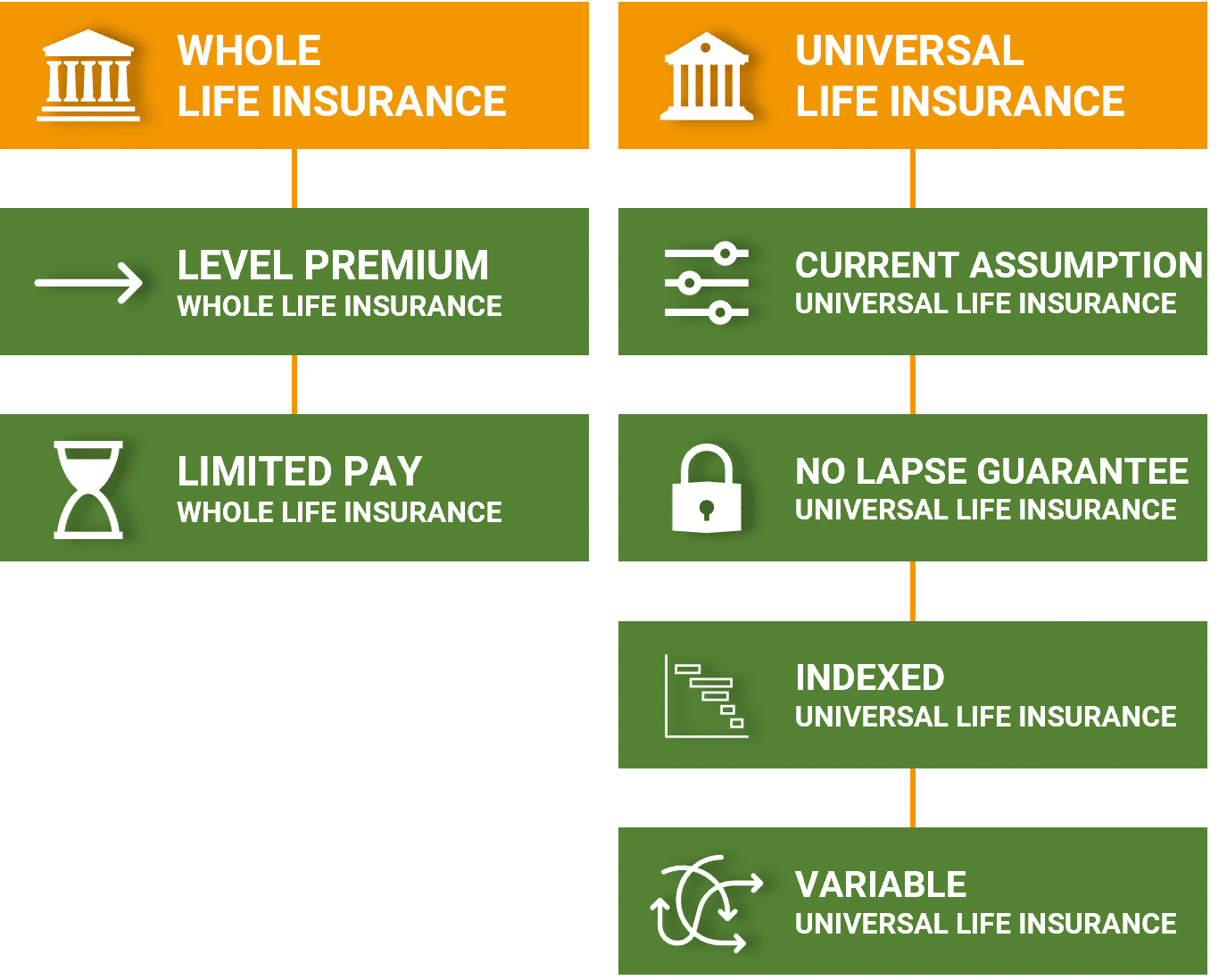

Generally, there are 2 YOURURL.com sorts of life insurance policy plans - either term or long-term strategies or some combination of both. Life insurance companies use different types of term plans and standard life policies as more information well as "interest delicate" items which have become extra prevalent considering that the 1980's. Commercial insurance in Dallas TX.

Term insurance provides defense for a given time period - Health insurance in Dallas TX. This period can be as short as one year or provide insurance coverage for a certain number of years such as 5, 10, 20 years or to a specified age such as 80 or sometimes approximately the oldest age in the life insurance policy mortality.

More About Home Insurance In Dallas Tx

Report this wiki page